Keeping accurate and up-to-date records is vital to the success of any business. Many business owners invest a lot of time and effort into the running of their business and yet fail to realize the importance of maintaining good documentation. As part of your obligations to Revenue Management as a Registered Company Tax Payer, you must keep records of all income and expenses for your business and for Revenue Management audit purposes. Good records will help you do the following:

Good records will keep you on your toes and enable you to monitor every situation. These records include:

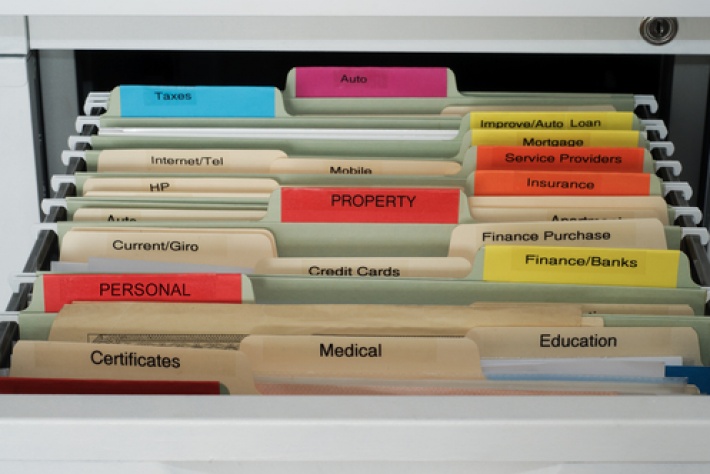

Use a spreadsheet to keep your records or a manual system as shown above using a hard-copy Filing System. See below for financial statements / templates for your review.

You need good records to monitor the progress of your business. Records can show whether your business is improving, which items are selling, or what changes you need to make. Good records can increase the likelihood of business success.

You need good records to prepare accurate financial statements. These include income (profit and loss) statements, cash flows, sales forecasts and balance sheets. These statements can help you in dealing with your bank or pay who you owe you money and help you manage your business. The following documents attached are intended as a guide only.

Unless you record them when they occur, you may forget expenses when you prepare your tax return.

You need good records to prepare your tax returns. These records must support the income, expenses, and credits you report. Generally, these are the same records you use to monitor your business and prepare your financial statement.

You must keep your business records available at all times for inspection by MFEM when required. If the MFEM examines any of your tax returns, you may be asked to explain the items reported. A complete set of records will speed up the examination.

Every person(s) carrying on a business or deriving an income (other than salary and wages) shall keep sufficient records to enable that person’s accessible income and allowable deductions to be readily determined by the Revenue Management Division. Refer to: Income Tax Act 1997.

These records must be held for at least five years, even if you stop operating. You don’t need to send your records or working papers with your tax return, but you must keep them in case Revenue Management wants to see them.

It’s a good idea to use a separate bank account for your business activity to record your income and expenses. Click here to find out more about Business Banking for your business.

Still not sure? If you need help with book keeping or not sure where to start, contact BTIB today. We can go through the various documents with you step by step. Call us today on +68224296 or email btib@cookislands.gov.ck.