When you start a business, there are tax responsibilities you need to know. Understand which taxes apply to your business type, and how to register for them.

If you are a business with no staff, this section may not be relevant to you at the moment however, it is recommended that you understand the obligations of an Employer who may have staff in future.

Your obligations as an Employer

As an employer, you must make deductions from payments you make to people who work for you. You must pay the deductions to Revenue Management. There are penalties for not fulfilling these obligations

Here’s a rundown on the business taxes you need to operate your business whether you are a Sole Trader or a business who has employees.

Taxes are a compulsory contribution to the Countries revenue. It is imposed or collected by the government on workers’ earning, business profits, or added to the cost of goods, services like VAT and other transactions.

Tax is every person’s fair share towards helping fund the Cook Islands way of life. ax money helps to ensure the roads you travel on are safe and well-maintained. Without them it would be impossible to pay for the country’s infrastructure services, its health, welfare and social services, its schools and its transport systems. Financial support is also given to other vital areas such as industry, tourism, heritage and culture.

An RMD (Revenue Management Division) number is your personal/business tax number which identifies you and/or your business to RMD, MFEM.

You need an RMD number if you are:

You can apply for an RMD number for:

If you have your RMD number already then all you do is register online via RMD’s e-Tax website to help you manage your tax returns. See below for details.

Stuck? If you have any enquiries regarding your registration, please contact Revenue Management Division: 29365 or email tax.info@cookislands.gov.ck

Register online with RMD’s e-Tax website. This will help you manage your tax returns online. It is much easier and faster way to complete your tax returns.

Make sure you have your RMD number. All you do is enter your email, full name, business name and RMD number of the business you are registering to access the Cook Islands’ Revenue Management Division eTax Website.

Once your registration is submitted, RMD will contact you to confirm your identity. It generally takes 4-5 working days to process. Note: only those authorized to access tax records for that RMD number provided will be registered as a user. Once your registration details have been confirmed you will receive an email with your temporary password.

Do you have staff? If you do, then PAYE is the basic “Pay As You Earn” tax which you as an Employer take out of your employees’ wages whenever you pay them. If you are a Sole Trader and don’t have any staff yet, then proceed to No. 4 – Pay Your Income Tax.

Deducting PAYE

When you start employing staff, RMD will send you a booklet of PAYE deduction tables containing the current tax rates so that you now how much to deduct from each employee’s pay. You can start downloading the Tax Deduction Certificate: Part A: Employee to complete and Part B: Employer to complete. You must send this to RMD for PAYE year ending 31 December.

Failing to make deductions

Employers must deduct PAYE from any payments made to employees. Failure to do this is a serious offence and can result in the employer being prosecuted.

What is VAT?

VAT is a tax on goods and services supplied in the Cook Islands by VAT-registered persons. It may also apply to imported goods and certain imported services. It is charged and accounted for at a rate of 15%. Anyone who carries on a taxable activity, or who intends to do so from a definite date, may register for VAT.

When to register for VAT

You must register for VAT if your turnover (sales from taxable activities), including certain imported services you receive:

Your returns can be filed monthly online or manually. You can choose to register even if your turnover is less than

$40,000 (but your turnover must be over $20,000 per annum). Before you register for VAT or as an employer, seek advice from us, an accountant or a tax advisor about whether or not they need to register. There may be financial implications if they need to de-register at a future date.

What to do after you’ve registered

When you’ve registered for VAT you must:

How does VAT work?

Most goods and services supplied in the Cook Islands have VAT added to the price. The exceptions are goods and services supplied by businesses not registered for VAT, and exempt supplies.

What information do I give my customers?

As a VAT-registered person, you’ll need to give your customers tax invoices.

The information you put on a tax invoice depends on the value of the goods or services being sold.

Additional tax

Additional tax is calculated at 5% for the first late month and 1% for every month that follows. If you need assistance with outstanding returns, please contact our collections team to discuss payment options.

NOTE: Make sure your business RMD number is clearly visible on all your business tax invoices.

Supplies exempt from VAT

VAT can’t be charged on some goods and service – these are called exempt supplies. The most common ones are:

REMEMBER: It Is important for records to be easily readable and organized enough for you or anyone to work through them quickly.

If you store your records on a computer, be sure to keep back-up copies in case your system breaks down. It Is a good idea to keep the back-ups off site.

Working out the VAT in a price

Depending on whether the total price includes or excludes VAT, use the following methods.

Cancelling your VAT registration

You can cancel your VAT registration if you dispose of your business, or you scale it down so your annual turnover is less than $40,000.VAT will need to be paid to Revenue Management on any assets retained.

How often do I file VAT returns?

Monthly – The taxable period is from the 1st of the month to the end of the month.

Due dates – The VAT filing due date is the 20th of the following month. If the due date for your VAT return falls on a weekend or public holiday, it will be due the next working day.

Don’t forget, send in your VAT return and payment on time to avoid additional tax.

Stuck? Please contact Revenue Management Division: 29365 or email tax.info@cookislands.gov.ck

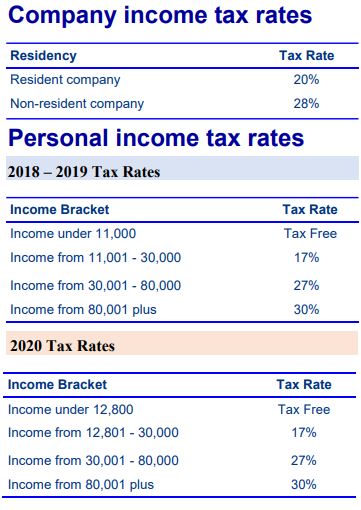

A tax return is documentation filed with RMD that reports income, expenses, and other relevant financial information. On tax returns, you as the taxpayer can calculate your tax, schedule tax payments, or request refunds for the over-payment of taxes. Tax returns are filed annually. How much tax do you pay? The way you receive income, through employment, or business determines how you calculate your income tax.

Sole Trader

If you’re in business in your own name, you’ll be responsible for all its income and debts. You pay income tax on your net profits. The taxable income is the net profit the business makes after deducting all allowable expenses.

Partnership

The net profit is shared between the partners and included in their personal income tax returns.

Company

If your business is owned by a limited liability company

and pays you a salary, you’ll be taxed on your salary as

an individual. The company’s gross revenue less all the business expenses (including your salary) determines it’s net profit. Any profits belonging to the company are taxed at the company tax rate of 20%.

Sole Proprietors, Partnerships, Employees and Companies only pay Income Tax. The Tax exemptions and Tax Rates differ by the business structure.

If you’re:

The standard tax year is 1st January – 31 December:

If you’re a business, sole trader, partnership or company the due date for filing your income tax return is 1st May following the year you are filing for.

If you earn a salary, wage or pension the due date for filing your income tax return is 1st March following the year you are filing. Don’t forget – You can file all your returns online, or download the forms you need.

Paying your income tax

The due date for paying any outstanding income

tax is the 1st of November following the tax year.

This means, you usually have 10 months to pay

any outstanding income tax

When making electronic payments, include:

Failure to submit your tax returns on time, may result in prosecution. See more info here: RMD Prosecution Guidelines.

Stuck? If you have any enquiries regarding business tax, please contact Revenue Management Division: 29365 or email tax.info@cookislands.gov.ck

.

Business Trade Investment Board

Opposite the Punanga Nui Market

Ruatonga

Avarua Rarotonga

Cook Islands

Telephone: +682 242 96

Fax: +682 24 298

Private Bag, Rarotonga, Cook Islands.

Email: btib@cookislands.gov.ck

Monday – Friday

8am – 4pm

Closed: Saturday and Sunday

Statutory Holidays