Whether you’re self-employed, a small or medium enterprise, or a professional practice, there are a number of business solutions personalised to your business requirements.

Here you can read the guide on what kind of bank you will choose. As many banks exist now in one area you have the advantage to choose what bank you will choose to be able to do your business transactions. Today, it is about the services and you can either go with the bank you know or consider another bank. Thanks to the competition you can now have some choices to make. You can see that there are three kinds of banks and there are some things for you to consider when doing business banking.

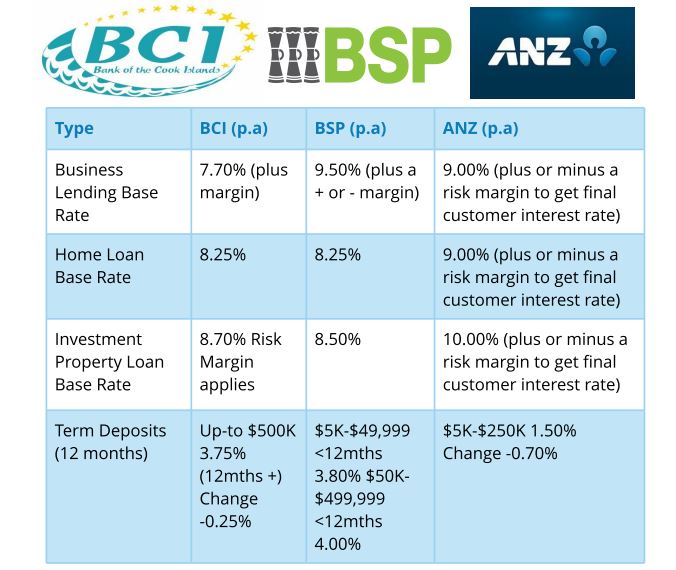

The following is a list of services, fees/charges, technology and loans information for your review. This is an excellent way to help you consider offering online services for your business as well. A good way for your potential customers or existing ones to transfer monies into your business account/s.

Check with your bank directly – individual banks service charges and fees are subject to change.

Terms & Conditions Apply (p.a – Per Annum)

ANZ – Changes will be reflected on website: (anz.com/cookislands) from 1 October 2020. BSP – Interest rates current as at 17th May 2021 (www.bsp.co.ck). Term Deposit: >12mths – On Application. Bank of the Cook Islands – (www.bci.co.ck). All interest rates provided are subject to change and bank terms & conditions and other fees may apply. Contact your bank directly.

Business Trade Investment Board

Opposite the Punanga Nui Market

Ruatonga

Avarua Rarotonga

Cook Islands

Telephone: +682 242 96

Fax: +682 24 298

Private Bag, Rarotonga, Cook Islands.

Email: btib@cookislands.gov.ck

Monday – Friday

8am – 4pm

Closed: Saturday and Sunday

Statutory Holidays